- Home

- Laptops

- Laptops News

- Icahn, Southeastern reveal board nominees as Dell seeks more info

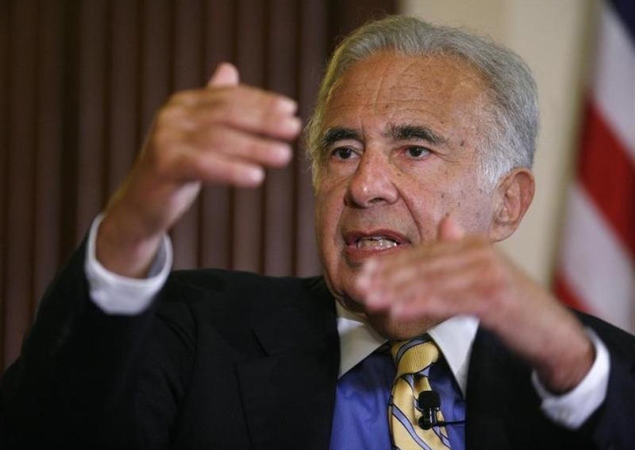

Icahn, Southeastern reveal board nominees as Dell seeks more info

Icahn and Southeastern Asset Management Inc, his ally in a battle with founder Michael Dell over the future of the world's No. 3 PC maker, on Monday put forward 12 Dell board of director candidates, including Icahn himself.

Last week, Icahn and Southeastern offered $12 in cash per share or additional shares to existing investors as an alternative to Michael Dell's $24.4 billion bid to take the company private. And the billionaire investor warned that if his leveraged recapitalization proposal was rejected, he would rally shareholders to vote down the Dell founder's offer and put up his own roster of candidates for the board.

Icahn's plan assumes that as much as 80 percent of the company's shareholding will opt for a cash payout, translating into a maximum outlay of $16.8 billion.

Michael Dell, major shareholders such as Southeastern and Icahn are waging a battle over the future of the company, once a tech-industry high flyer but now struggling to evolve as people embrace smartphones and tablet computers.

Michael Dell and private equity firm Silver Lake want to take the company private for $13.65 per share, but stockholders, including Southeastern and T. Rowe Price Group Inc, have complained that offer severely undervalues the company.

Instead, Icahn and Southeastern, two of Dell's biggest investors, proposed to give stockholders $12 cash or shares for every share they own, as well as allow them to keep their stock.

The alternate board proposed by the two groups includes Bernard Lanigan Jr., chief executive of Southeast Asset Advisors: Rahul Merchant, New York City's chief information officer, and Jonathan Christodoro, managing director at Icahn Capital.

A spokesman for Merchant said he had received New York City's approval for his nomination on condition that he recuse himself from any dealings with Dell or any company affiliated with Southeastern in order to avoid any conflict of interest.

Other nominees include Icahn Enterprises President Daniel Ninivaggi, who previously sat on the board of Motorola Mobility Holdings, and Harry Debes, a technology veteran who is currently an operating partner with buyout firm Advent International Corp.

Shareholders last week welcomed the alternative proposal, which they said sustained a discussion around Dell's future. But investors might find the latest option on the table unpalatable because of a lack of specifics, some analysts say.

"Most shareholders would prefer the certainty of $13.65 in cash rather than risk the uncertainty and the ensuing stock volatility," Jefferies & Co analyst Peter Misek wrote in a Monday research note. "Our estimates point to possible minimal upside to the $13.65 Silver Lake offer, which we do not think would warrant the potential volatility."

Icahn is being advised by investment bank Jefferies Group.

In a letter to Icahn, the committee said it was not clear if he intended to make "an actual acquisition proposal that the board could evaluate," or if he intended his offer as an alternative in the event the pending sale to Silver Lake and Michael Dell is not approved.

Dell shares ended regular trading on Monday at $13.52, up 0.5 percent.

Quiz

Icahn and Southeastern's challenge comes after Blackstone Group LP ended its pursuit of Dell in April and pulled out a month after it teamed up with Icahn to challenge the take-private attempt.

Icahn argued in a letter sent to the board and made public in a filing on Friday that Dell operates a large enterprise-focused computing business in addition to its ailing PC division, with strong ties Microsoft Corp and Intel Corp.

Without specifying details, he also said cost savings could be had from merging assembly plants across the world, while there remained opportunities to spin off non-core businesses.

Apart from asking who would make up the company's senior management team under Icahn, the committee said in its Monday letter that it wanted to know his "strategy and operating plan."

The committee also asked for information on the terms of the debt financing required for Icahn's proposal and "contingencies available if cash on hand or stockholder rollovers are less than anticipated," as well as financing commitment letters.

It said the proposal did not seem to take into account the additional borrowing required if Icahn uses the company's cash in the transaction and reduces future cash flow by selling receivables. In addition, it asked for an analysis of whether the receipt of additional shares would be taxable.

It also wanted to know more about the relationship between Icahn and Southeastern.

Icahn was not available for comment.

Both Icahn and Southeastern said they would finance the proposal from existing cash and about $5.2 billion in new debt.

Icahn and Southeastern together hold about 12 percent of Dell stock. The billionaire investor previously proposed paying $15 per share for 58 percent of Dell.

(Also see: Dell takeover battle: All you need to know)

© Thomson Reuters 2013

For the latest tech news and reviews, follow Gadgets 360 on X, Facebook, WhatsApp, Threads and Google News. For the latest videos on gadgets and tech, subscribe to our YouTube channel. If you want to know everything about top influencers, follow our in-house Who'sThat360 on Instagram and YouTube.

Related Stories

- Galaxy S24 Series

- MWC 2024

- Apple Vision Pro

- Oneplus 12

- iPhone 14

- Apple iPhone 15

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Huawei Pura 70 Pro

- Huawei Pura 70

- Vivo V30e

- Itel Super Guru 4G

- Huawei Pura 70 Pro+

- Huawei Pura 70 Ultra

- Tecno Camon 30 Premier 5G

- Motorola Edge 50 Fusion

- Asus ZenBook Duo 2024 (UX8406)

- Dell Inspiron 14 Plus

- Realme Pad 2 Wi-Fi

- Redmi Pad Pro

- Cult Shock X

- Fire-Boltt Oracle

- Samsung Samsung Neo QLED 8K Smart TV QN800D

- Samsung Neo QLED 4K Smart TV (QN90D)

- Sony PlayStation 5 Slim Digital Edition

- Sony PlayStation 5 Slim

- Voltas 1.5 Ton 3 Star Split AC (183 Vectra Elegant 4503545)

- Hitachi 1.5 Ton 5 Star Inverter Split AC (RAS.G518PCBISF)