- Home

- Laptops

- Laptops News

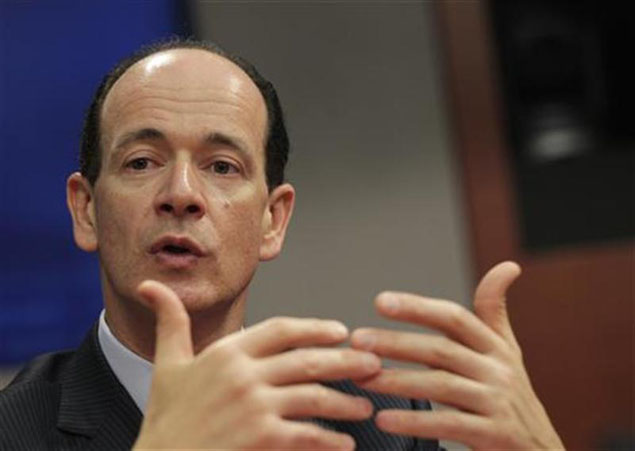

- Symantec replaces CEO, successor promises turnaround

Symantec replaces CEO, successor promises turnaround

Shares of Symantec jumped nearly 14 percent on Wednesday's news as some investors speculated that Bennett might consider divesting assets or splitting up the company. Symantec also issued a quarterly outlook on Wednesday that was below analysts' projections as it reported earnings for the fiscal first quarter.

"I took this job because I believe that our assets are better than our performance," Bennett told analysts on a conference call.

Bennett, 58, is a former CEO of financial software maker Intuit Corp who was also an executive at General Electric Co . He declined to say whether he would consider divesting any assets, but said he was not brought in to sell the company.

"The agreement I have with the board is to create long-term shareholder value," he said. "This is my third job in a 35-year business career. This will be my last job."

Investor disappointment with Symantec's performance traces back to 2004, when Salem's predecessor, John Thompson, announced plans to buy storage software maker Veritas for $13.5 billion.

The deal failed to generate the growth that Thompson had envisioned. Symantec -- whose rivals include Intel Corp's McAfee division in security along with EMC Corp , Oracle Corp and CommVault Systems Inc in storage -- reported mixed results in the following years, repeatedly disappointing Wall Street.

Salem, 48, inherited that legacy when he took over as CEO three years ago and the problems continued under his leadership. Over the course of his tenure as CEO, Symantec shares fell about 19 percent, while the Nasdaq Composite Index climbed about 77 percent.

Salem could not be reached for comment.

For the past few years investors have advocated selling off either the old Veritas division or Symantec's highly profitable consumer business, which makes the widely used Norton anti-virus software.

Symantec shares now trade for about half of what they were worth the day before the Veritas deal was announced nearly eight years ago.

Taking action

Bennett said that Symantec's board members decided to fire Salem after determining it was time to intervene to improve the company's performance.

"Our current record hadn't been so good," Bennett told Reuters in an interview. "We kept on trying to figure out 'Have we been doing everything as a board that we should be doing to create shareholder value?'"

The board discussed the matter at a dinner on Monday evening, then voted at a formal meeting on Tuesday, he said. Bennett visited Salem at his office on Monday to let him know that his job was at risk.

Salem left the office after Tuesday's board meeting, according to the company.

FBR Capital Markets analyst Daniel Ives said that the departure of Salem opened up "a range of possibilities" that could help the stock.

"Investors will interpret this as a clear, positive sign that Symantec and its board are finally willing to move in the right direction," Ives said.

Barclays analyst Raimo Lenschow said that Bennett was "well-regarded" for his record as CEO of Intuit and said his appointment was "an encouraging start." But Lenschow cautioned that Wednesday's rally in Symantec shares might not last.

"We still prefer to wait for consistent delivery of any turnaround before becoming more bullish on the stock in the long term," he said in a note to clients.

He has an "equal weight" rating on the stock and a price target of $18.

Bennett's way

Bennett said he planned to fix Symantec using tools he learned in the first part of his career, a 23-year stint managing a diverse group of businesses for General Electric.

Bennett said he will conduct a review over three to four months that will include a "listening and learning tour" to meet with customers, employees and partners around the world.

He said he became proficient at engineering turnarounds while at GE, where the company gives managers new assignments every three or four years.

"I've done this between five and 10 times in my career. I actually have a methodology and playbook that I go in with," he said in the interview.

GE's practice of moving managers around and charging them with improving the results of their divisions has turned the conglomerate into one of the largest corporate training grounds for U.S. executives.

Bennett left GE in 2000 to become Intuit's CEO.

Recent GE alumni include Textron Inc CEO Scott Donnelly, a former GE aviation executive. Textron shares have since risen about 25 percent from recessionary lows as Donnelly has shaken up management and focused on margin improvement.

Bennett said he will tell investors how he plans to apply the GE play book to Symantec's problems toward the end of his strategic review, though smaller operational changes may be revealed sooner than that.

Symantec's board previously considered hiring Bennett as CEO at least once.

Bennett said on the conference call he was on a "short list" of candidates that the board reviewed in a "dry search" before approving Salem's promotion to the CEO position in 2009.

But the board followed up in February 2010 by naming Bennett as a director, then appointing him chairman the following year when Thompson retired from that post.

Weak outlook

Symantec forecast fiscal second-quarter earnings per share in a range of 35 to 39 cents, below the Wall Street view of 40 cents, according to Thomson Reuters I/B/E/S.

The company also forecast revenue would drop about 1 percent, to between $1.635 billion and $1.665 billion. That is below the $1.69 billion average analyst estimate.

Symantec reported a profit, excluding items, of 43 cents a share for the fiscal first quarter ended on June 29. That was above the 38-cent average estimate of analysts. First-quarter revenue grew 1 percent from a year earlier to $1.67 billion, slightly ahead of analysts' average estimate of $1.65 billion.

Symantec shares rose 13.5 percent to end at $14.96 on the Nasdaq on Wednesday. That compares with a closing price of $27.38 the day before the Veritas deal was announced in December 2004.

Copyright Thomson Reuters 2012

For the latest tech news and reviews, follow Gadgets 360 on X, Facebook, WhatsApp, Threads and Google News. For the latest videos on gadgets and tech, subscribe to our YouTube channel. If you want to know everything about top influencers, follow our in-house Who'sThat360 on Instagram and YouTube.

Related Stories

- Galaxy S24 Series

- MWC 2024

- Apple Vision Pro

- Oneplus 12

- iPhone 14

- Apple iPhone 15

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Huawei Pura 70 Pro+

- Huawei Pura 70 Ultra

- Tecno Camon 30 Premier 5G

- Motorola Edge 50 Fusion

- Oppo A1i

- Oppo A1s

- Motorola Edge 50 Ultra

- Leica Leitz Phone 3

- Asus ZenBook Duo 2024 (UX8406)

- Dell Inspiron 14 Plus

- Realme Pad 2 Wi-Fi

- Redmi Pad Pro

- Cult Shock X

- Fire-Boltt Oracle

- Samsung Samsung Neo QLED 8K Smart TV QN800D

- Samsung Neo QLED 4K Smart TV (QN90D)

- Sony PlayStation 5 Slim Digital Edition

- Sony PlayStation 5 Slim

- IFB 2 Ton 3 Star Inverter Split AC (CI2432C323G1)

- Daikin 1 Ton 3 Star Inverter Split AC (FTKL35UV16W+RKL35UV16W)