- Home

- Internet

- Internet Features

- Politics, Mobile Overshadow Alibaba's Fairy Tale Run

Politics, Mobile Overshadow Alibaba's Fairy-Tale Run

The Chinese e-commerce giant has acquired a rosy aura since its record-breaking IPO last spring, revealing growth rates and volumes that dwarfed industry stalwarts Amazon Inc and eBay Inc.

Now, Wall Street is cutting back on expectations in part because of fears that Chinese regulators are sharpening their scrutiny of counterfeit products on e-commerce sites, an endemic problem that Alibaba and others have fought for years.

"As the China-factor gets tempered, then excitement (around Alibaba) is going to get tempered as well," Cantor Fitzgerald's Youssef Squali said, after cutting estimates for 2015 revenue and earnings. "At some point, you're not going to dominate the market and you're just going to grow in line with the market. But we're not there yet," he added.

The gradual migration of users to mobile platforms threatens to weigh on the top line. On Thursday, Alibaba disappointed with 40 percent revenue growth and a monetization rate, the percentage of ecommerce transactions it earns, below Wall Street expectations. That was due to the rising proportion of purchases on mobile devices, from which Alibaba earns less. Its stock fell 9 percent.

Alibaba-watchers were also treated to the unusual sight of a company, regarded as a standard-bearer for a burgeoning technology industry, trading barbs with a government body. China's State Administration for Industry and Commerce (SAIC) surprised investors by publishing a scathing report - since pulled from its website - lambasting the company for not doing enough to suppress counterfeits.

Throw in questions around how much the world's largest economy will decelerate, and the Alibaba picture begins to look less than certain for 2015.

"Alibaba does outline anti-counterfeit measures in its filings, but the SAIC report puts the effectiveness of these measures into question," Stifel analysts Scott Devitt and George Askew wrote on Thursday as the brokerage downgraded Alibaba to a hold from a buy. "The perception issue may persist."

It is unclear whether the SAIC intends any specific action. But the Chinese company is sensitive to accusations about its efforts to suppress counterfeit products. Meanwhile Beijing, facing persistent U.S. pressure, has declared protecting intellectual property a government priority.

Alibaba's Vice Chairman Joseph Tsai fired back on Thursday, accusing the influential body of "flawed" methodology and preparing to file a formal complaint.

Hold on there

To be sure, Alibaba's 40-plus percent growth in revenue and gross merchandise value remains the envy of its rivals. It has been able to sustain that pace thanks to its 80 percent share of a Chinese online market that industry executives agree still has enormous room to grow.

But the world's largest economy is poised to decelerate after years of eye-popping growth. Economists also warn of a property market deflation and pressure on wage growth.

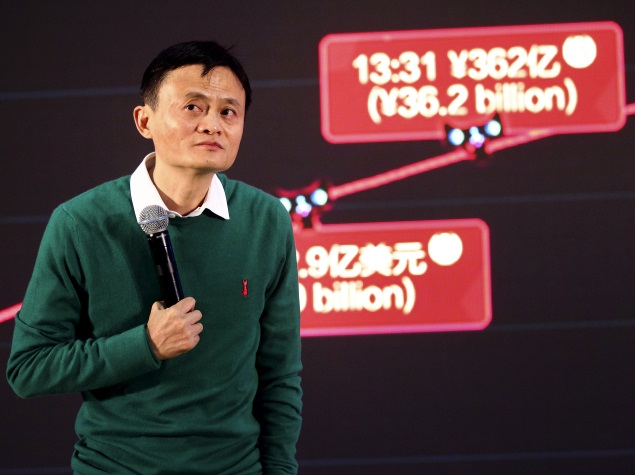

Last week, Alibaba Chairman Jack Ma brushed aside fears that a slowdown may squeeze his company.

Yet while e-commerce should continue to grow in the Middle Kingdom, the increasing shift to mobile commerce means that the amount Alibaba actually earns will come under downward pressure.

Two-thirds of the company's sales still come from its consumer-to-consumer marketplace Taobao, where it primarily earns revenue from advertising and marketing services. As with Google Inc and Facebook Inc, Alibaba charges less for marketing on mobile devices than on computers.

It reported a monetization rate of just below 2 percent from mobile, which now comprises 42 percent of overall gross merchandise value versus 36 percent in the previous quarter.

"Near-term predictability of growth and margins has deteriorated given the company's continued transition to mobile and changes to its user experience," Cantor Fitzgerald's Squali wrote in a research note. "This is amplified by recent tensions with SAIC."

© Thomson Reuters 2015

For the latest tech news and reviews, follow Gadgets 360 on X, Facebook, WhatsApp, Threads and Google News. For the latest videos on gadgets and tech, subscribe to our YouTube channel. If you want to know everything about top influencers, follow our in-house Who'sThat360 on Instagram and YouTube.

Related Stories

- AI

- iPhone 16 Leaks

- Apple Vision Pro

- Oneplus 12

- iPhone 14

- Apple iPhone 15

- OnePlus Nord CE 3 Lite 5G

- iPhone 13

- Xiaomi 14 Pro

- Oppo Find N3

- Tecno Spark Go (2023)

- Realme V30

- Best Phones Under 25000

- Samsung Galaxy S24 Series

- Cryptocurrency

- iQoo 12

- Samsung Galaxy S24 Ultra

- Giottus

- Samsung Galaxy Z Flip 5

- Apple 'Scary Fast'

- Housefull 5

- GoPro Hero 12 Black Review

- Invincible Season 2

- JioGlass

- HD Ready TV

- Laptop Under 50000

- Smartwatch Under 10000

- Latest Mobile Phones

- Compare Phones

- Vivo Y18e

- Vivo Y18

- Vivo Y38 5G

- Nokia 235 4G (2024)

- Nokia 225 4G (2024)

- Nokia 215 4G (2024)

- Redmi Note 13 Pro+ 5G World Champions Edition

- Infinix GT 20 Pro

- Dell Alienware X16 R2

- Lenovo IdeaPad Pro 5i

- Realme Pad 2 Wi-Fi

- Redmi Pad Pro

- boAt Storm Call 3

- Lava ProWatch Zn

- Samsung Samsung Neo QLED 8K Smart TV QN800D

- Samsung Neo QLED 4K Smart TV (QN90D)

- Sony PlayStation 5 Slim Digital Edition

- Sony PlayStation 5 Slim

- Lloyd 1 Ton 3 Star Inverter Split AC (GLS12I3FWAEV)

- Voltas 1.5 Ton 5 Star Inverter Split AC (185V Vectra Elite)